-Darren Leavitt, CFA

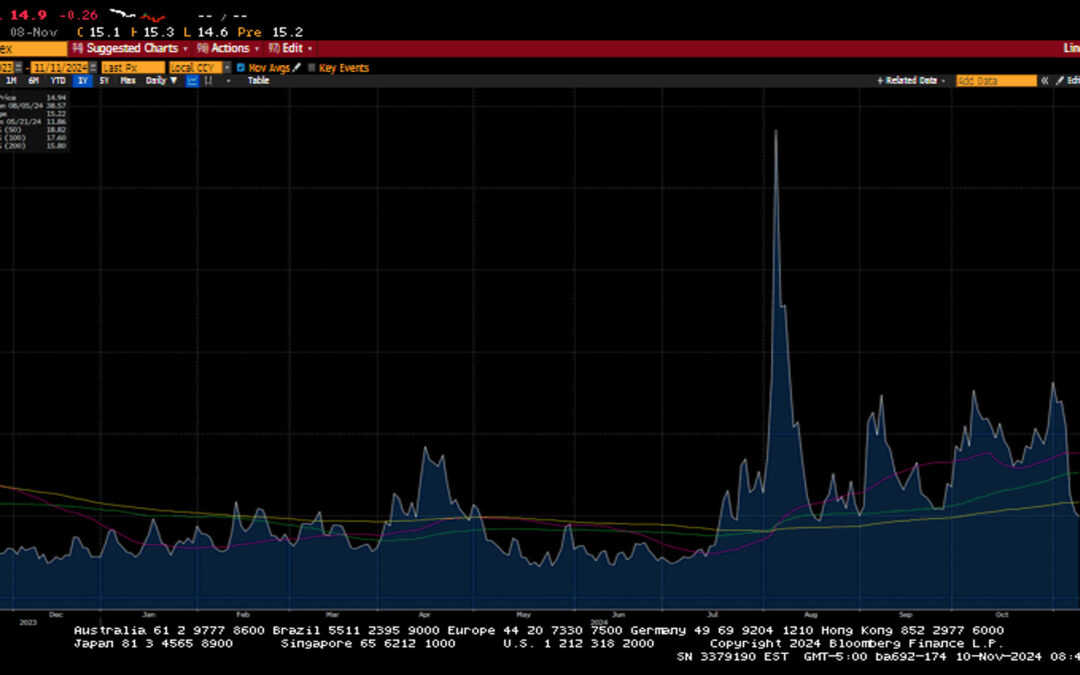

The S&P 500 notched its 50th all-time high of 2024 as investors piled into equities after a decisive US election. Wall Street embraced the idea that President-Elect Trump would enact several pro-growth policies to bolster corporate profits. Lower taxes, deregulation, and a protectionist stance on trade sent Small-caps, Financials, and Technology higher. The definitive results sent VIX, a measure of volatility, lower by 5 points or nearly 22% in a single day! The notion of lower taxes and no fiscal austerity initially hit the bond market, where the US 10-year yield advanced by seventeen basis points. Interestingly, the bond market settled down over the next three sessions to end the week higher.

A twenty-five basis point cut by the Federal Reserve was announced as a unanimous decision on Thursday. A dovish Powell recognized the strong US economy, the resilient labor market albeit weaker than the beginning of the year, and the progress on inflation without signaling a definitive stance on a rate cut at the Fed’s December meeting. Fed Funds futures currently assign a 65% probability of a twenty-five basis point rate cut at the December meeting.

91% of the S&P 500 companies have reported third-quarter results. It has been a mixed bag of results, but on the margin, Earnings per Share growth has been slightly better than expected. Notable results this week came from Palantir, Novo Nordisk, Global Foundries, Taiwan Semiconductor, McKesson, Exact Sciences, Moderna, Applovin, and Qualcomm.

The S&P 500 gained 4.95%, the Dow rose by 5.25%, the NASDAQ added 6.08%, and the Russell 2000 rocketed higher by 8.13%. US Treasury yields were mixed across the curve in volatile trade, with lower duration constituent yields increasing while longer-tenured paper saw yields fall. The 2-year yield increased by five basis points to 4.25%, while the 10-year yield fell by five basis points to 4.31%. Oil prices increased by 1.2% or $0.86 to $70.38 a barrel. Gold prices fell by 2% or $55.80 to $2693.70 an OZ. Copper prices fell by six cents to $4.31 per Lb. Bitcoin rallied nearly 10% to close at $76,350 on Friday and, as I write, has topped $80k for the first time. The US Dollar Index gained 0.7% on the week to close at 105.03.

The economic calendar was relatively light this week. October ISM Services showed a robust US services sector with a better-than-expected print of 56, up from the prior reading of 54.9. Initial Claims were up by 3k to 221k, while Continuing Claims added 39k to 1.892M. Q3 productivity came in line at 2.2%, while Unit Labor Costs exceeded estimates at 1.9%. A preliminary look at November’s University of Michigan’s Consumer Sentiment showed continued strength with a reading of 73 versus the prior reading of 70.5.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.