Weekly Market Commentary – 12/1/2023

-Darren Leavitt, CFA

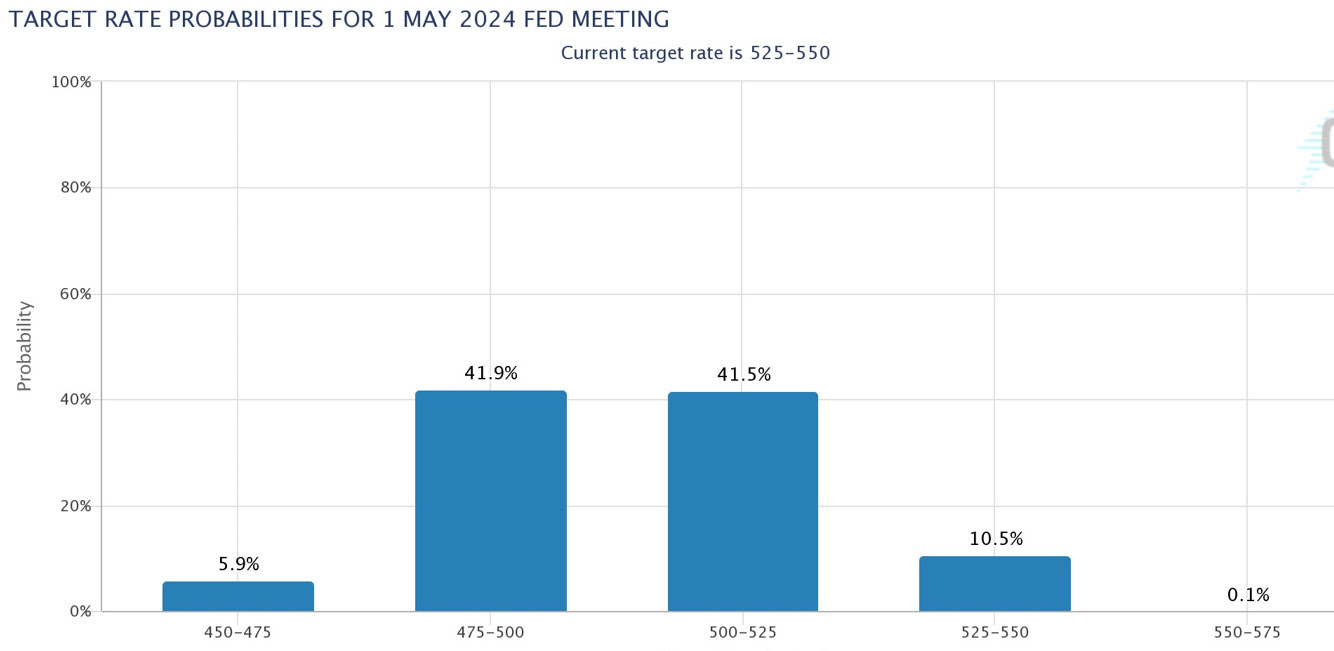

A mélange of factors pushed US equity markets to a sneeze away from record highs. US Treasuries continued to rally, sending yields lower across the curve. The soft landing narrative continued as investors digested economic data that showed moderating inflation alongside a resilient labor market and stronger than expected GDP growth rate in the third quarter. Investors seemed to dismiss multiple Fed Speakers’ suggestions that it was premature to start considering rate cuts. However, Fed Funds futures suggest a 63.4% probability of a cut by March and nearly a 90% chance of a cut by May. The Fed has now gone into its quiet period ahead of the December FOMC meeting, where it is widely expected that they will keep their policy rate unchanged. However, the meeting will telegraph the Fed’s most recent views on the dot plot which shows each member’s projection of the policy rate. If these projections are meaningfully different from what is currently priced in the market, investors may be inclined to sell the current rally which currently looks a bit overbought.

The S&P 500 gained 0.8% while the equally weighted S&P 500 index outperformed, gaining 2.5%. The S&P 500 sits just below its 52-week high of 4607.07, closing at 4594.63. The Dow added 2.4%, the NASDAQ increased by 0.4%, and the Russell 2000 jumped 3.1%. US Treasuries continued to rally with shorter-dated tenors acting a bit better. The 2-year yield fell thirty-nine basis points to 4.56%, while the 10-year yield decreased by twenty-four basis points to 4.23%.

Oil prices continued to struggle despite the announcement by OPEC+ that they would reduce production by 2.2 million barrels per day. The delayed meeting left investors questioning if OPEC+ has the ability to cut further if prices continue to decline, and it also left question marks on compliance with the announced cuts. West Texas Intermediate fell $1.14 or 1.5% on the week to close at $74.04 a barrel. Gold prices continued to rally, increasing by 4% or $86.30 to close at $2089.70. Copper prices increased by over 8% to $3.93 a Lb. Bitcoin rallied on news that the SEC and Blackrock had meetings to discuss Blackrock’s application to launch a spot Bitcoin ETF- Bitcoin is trading a $39,500 as I write. The dollar index lost 0.1% on the week.

Economic data for the week was headlined by the Fed’s preferred measure of inflation, PCE. PCE came in flat on a month-over-month basis, slightly lower than the consensus estimate of 0.1%. The measure increased by 3% year-over-year, down from September’s 3.4% advance. Core PCE came in line with expectations at 0.2% and also showed moderation on a year-over-year basis of 3.5%, down from 3.7% in September. The decline in core prices is encouraging but is still well above the Fed’s target of 2%. Personal Income and Spending came in line with expectations at 0.2%. The 2nd estimate of third-quarter GDP surprised to the upside with a reading of 5.2% growth. The GDP price Deflator came in as expected at 3.6%. Consumer Confidence was a bit better than expected at 102 versus 100. ISM Manufacturing came in at 46.7, which shows the manufacturing sector is still in contraction. New Home sales came in below estimates at 679k, while the S&P Case Shiller Home price index increased by 3.9%. Initial Jobless Claims rose by 7k to 218k, while Continuing Claims increased by 86k to 1927k.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.