Weekly Market Commentary – 9/15/2023

-Darren Leavitt, CFA

It was a roller coaster ride on Wall Street this week, with early-week gains met with a late-week sell-off. Investors cheered the largest IPO of the year that saw Arm Holdings come to market 10x oversubscribed at a valuation north of $50 billion. Apple’s new product launch was not enough to stop the selling pressure that started last week on concerns that the Chinese government would ban Apple products and curtail demand for iPhones. Lackluster earnings from Adobe and a warning from Netflix on disappointing trends in advertising revenues further hindered the Mega-Cap Technology issues. Semiconductors were noticeably weak on TSM’s announcement that the company would slow production of its semiconductor equipment.

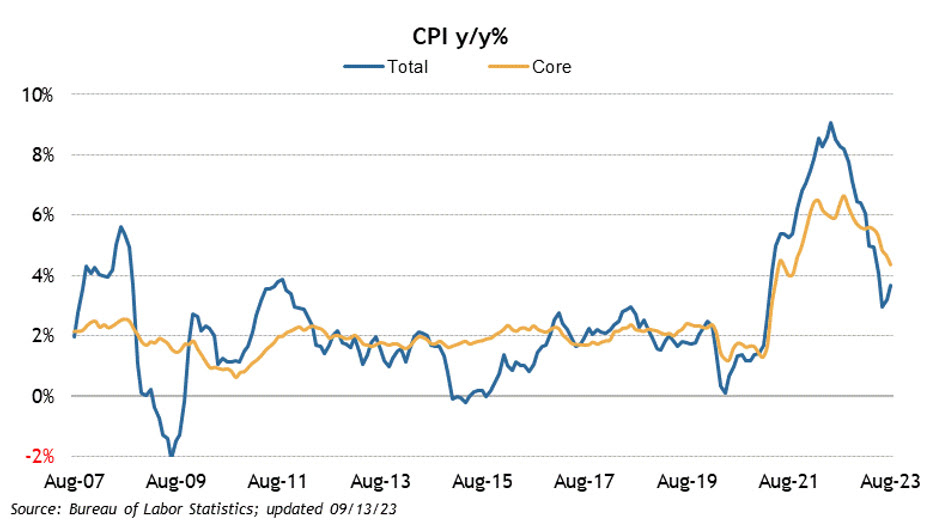

Additionally, several airlines cut their earnings estimates due to a sharp increase in fuel costs. WTI crude increased $2.53 this week to close at over $90 a barrel. The ECB increased its policy rate for the tenth time in its rate hike cycle by 25 basis points. However, the central bank signaled that it would pause to digest further data while letting its tightening policy work into the economy. The dovish tone sent the Euro and British Pound lower against the dollar. The United Auto Workers also went on strike as the Big Three and union leaders could not come to an agreement. It’s estimated that the strike could cost as much as 500 million a week until resolved. The economic data released this week was highlighted by a material increase in headline CPI caused by the sharp increase in oil prices over the last couple of months.

The S&P 500 lost 0.2%, the Dow increased by 0.1%, the Nasdaq fell by 0.4, and the Russell 2000 gave up 0.2%. The S&P 500 and Nasdaq broke below their 50-day moving averages, keeping the prospect of a larger sell-off in play. The US Treasury market continued to sell off on concerns that inflation will continue to be elevated, forcing the Federal Reserve to keep rates higher for longer. The 2-year yield increased by seven basis points to 5.04%, while the 10-year yield also increased by seven basis points to 4.33%. Of note, these yields are a sneeze away from their cycle highs. As I mentioned, oil prices continued to climb, closing at $91 a barrel. Several analysts have increased their estimate of year-end crude prices to as much as $100 a barrel- another issue the Federal Reserve will need to incorporate into their inflation estimates. Gold prices increased by $2.30 to $1945.60 an Oz. Copper prices advanced by $0.08 to close at $3.80 a Lb.

Headline CPI came in at 0.6%, in line with expectations, and was up 3.7% on a year-over-year basis from the 3.2% registered in July. Core CPI that excludes food and energy prices increased by 0.3% and was up 4.3% year-over-year but down from July’s year-over-year reading of 4.7%. Producer prices increased by 0.7%, higher than the 0.5% estimate, while the Core number came in a bit lighter at 0.2%. Retail Sales increased by 0.6%, much higher than the 0.1% estimate; however, the bulk of these gains came from gasoline sales that increased 5.2% on higher fuel costs. Initial Claims increased to 220k for the week and were in line with estimates. Continuing Claims increased by 4k to 1688k. Next week’s data will highlight the housing market’s current state, and we will look at the August Leading Indicators. The Federal Reserve will conclude its Open Market Committee on Wednesday afternoon, where it is widely expected that the central bank will keep its policy rate unchanged. Investors will focus on the Fed’s Summary of Economic Projections for clues on the future path of interest rates and J Powell’s post-meeting comments.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.