Weekly Market Commentary – 7/28/2023

-Darren Leavitt, CFA

It was a busy week on Wall Street with announcements of monetary policy decisions from the Federal Reserve, European Central Bank, and the Bank of Japan, along with an active calendar of Q2 earnings announcements and economic data.

As expected, the Federal Reserve raised its policy rate by twenty-five basis points to 5.25%-5.50%. Fed Chairman Jerome Powell continued to push back on the notion that the Fed was finished with the rate hikes. Instead, he suggested the Fed will remain data-dependent and craft policy to achieve its price stability and full employment mandates. The Fed Funds futures now price in a 29.7% probability of a 25 basis point by November. The European Central Bank also increased several of its policy rates by a quarter point but came across as more dovish than expected, with some speculating the ECB could be done with its hiking cycle. The Bank of Japan kept its policy rate the same but surprised markets by announcing it would loosen its yield curve control. The news had been rumored early in the week and perhaps was one catalyst for the sell-off on Thursday. However, the Yen was little changed against the US Dollar for the week, and markets seemed to shrug off the announcement on Friday. Investors will hear from the Bank of England this week, where the BOE is expected to announce a fifty basis point hike.

Q2 earnings continued to flood in, and the margin continued to impress. Meta and Google were highlighted this week with better-than-expected results and strong guidance, which propelled their stocks higher. Boeing, J&J, and P&G also had solid results. Microsoft was a bit of a disappointment but beat expectations, just not by enough, given the recent run-up in the name. The coming week will be the busiest so far this earnings season.

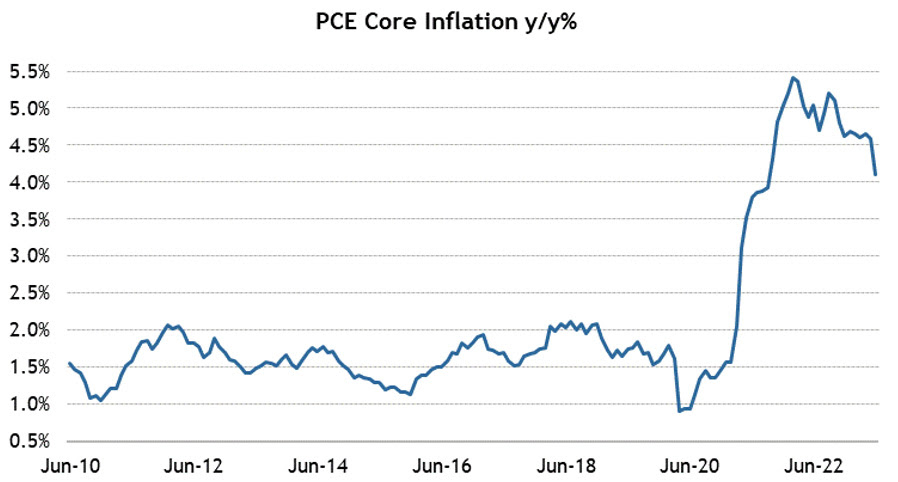

The economic calendar was packed. PCE, the preferred measure of inflation, showed that headline and core prices in the data set have moderated on a year-over-year basis. The headline number came in up 0.2%, in line with expectations, while it fell to 3% year-over-year from May’s level of 3.8%. Similarly, the Core number was up by 0.2% in June, in line with estimates, and fell to 4.1% from Mays’s figure of 4.6%. Advanced estimate of Q2 GDP impressed with a growth rate of 2.4% versus expectations of 1.8%. The GDP Deflator came in at 2.2%, less than the 3.1% estimate. Personal Income came in at 0.3%, below the estimated 0.4%, while Personal Spending came in better than expected at 0.5% vs. 0.3%. Consumer Confidence was much better than anticipated at 117, and the Final Reading of Consumer Sentiment from the University of Michigan showed significant improvement from June, coming in at 71.6 from 64.4. Initial claims came in at 221k, and Continuing Claims fell to 1690K.

The S&P 500 gained 1%, the Dow added 0.7%, the NASDAQ jumped 2%, and the Russell 2000 increased by 1.1%. US Treasury yields increased across the curve. The 2-year yield increased by five basis points to 4.9%, while the 10-year yield rose by thirteen basis points to 3.97%. West Texas Intermediate crude price rose by 4.5% or $3.49 to close at $80.54 a barrel. Gold prices fell by $6.20 to $1960.30 an Oz. Copper prices increased by $0.10 to 3.92 a Lb.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.