Weekly Market Commentary – 5/5/2023

-Darren Leavitt, CFA

Investors were treated with an extremely busy start to May. Central bank decisions on monetary policies and more first-quarter earnings were front and center, while there was a full slate of economic data to digest. Regional bank woes continued despite JP Morgan’s takeover of troubled First Republic Bank.

The Federal Reserve raised its policy rate by 25 basis points to 5%-5.25%. Fed Chairman Powell did suggest that the Fed would likely pause in raising rates further but, at the same time, backed away from the notion that they would be cutting rates anytime soon. However, the market is currently pricing in the possibility of a rate cut in their November meeting. Yields fell meaningfully on the front end of the curve, while longer-duration Treasury yields remained flat to higher. The European Central Bank also raised its policy rate by 25 basis points but indicated it still had more work to do concerning its policy rate to bring in inflation. The Hong Kong Monetary Authority raised its rate by 25 basis points, as did Norway’s Norges Bank. Fears that the global economy will contract and lead to recession due to tighter financial conditions hit the cyclical sectors and the price of oil. Exxon Mobil was downgraded by Goldman Sachs to neutral from a buy and further dampened sentiment on the energy complex.

First-quarter earnings continued to come in with better-than-expected results on the margin. Nearly two-thirds of the S&P 500 companies have reported and generally have produced better results on the top and bottom lines. Apple posted a great quarter, as did Starbucks, Amerisource Bergen, Pfizer, and Zillow- to name a few.

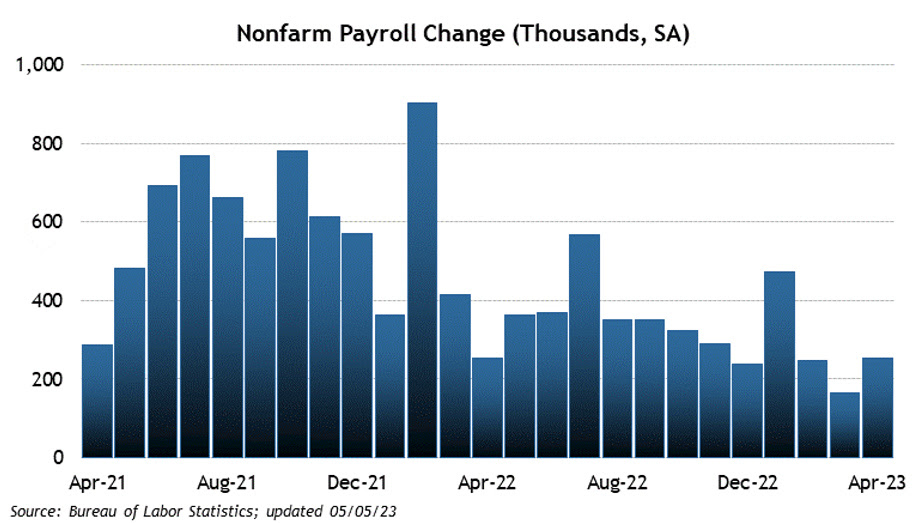

The April Employment Situation Report highlighted the economic calendar. Non-Farm Payrolls surprised to the upside, with 253k payrolls created versus the consensus estimate of 180k. Private Payrolls also beat expectations with a gain of 230k. The Unemployment rate fell to 3.4% from 3.5%; the street was looking for an uptick to 3.6%. Average Hourly Earnings were higher than expected, coming in at 0.5% on a month-over-month basis relative to the consensus estimate of 0.3%. The ADP payroll number was consistent with the report, coming in at 296k versus 142k. Initial claims for the week came in at 242k, and Continuing Claims ticked down to 1.805 million from 1.843 million. JOLTS data continued to show many jobs available in the US economy. The robust labor statistics fostered the idea that a soft landing may be in play and helped to push the US equity market higher on Friday.

For the week, the S&P 500 lost 0.8%, the Dow gave back 1.2%, the NASDAQ gained 0.1%, and the Russell 2000 shed 0.5%. The 2-year note yield fell by fifteen basis points to 3.91%, while the 10-year yield closed unchanged for the week at 3.45%. Oil prices fell nearly 7% or $5.34 to $71.42 a barrel. Gold prices increased by $25.90 to $2024.60 an Oz. Copper prices were unchanged for the week, closing at $3.89 a Lb.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.