Weekly Market Commentary – 4/28/2023

-Darren Leavitt, CFA

Markets ended the month of April with slight gains for the large-cap indices and small losses for the small-caps. Q1 earnings continued to be in focus as some of the most influential companies posted mixed results. The week also had a busy economic calendar that showed a slower-than-expected preliminary Q1 GDP reading and persistent inflation.

According to Factset, 53% of S&P 500 companies have reported first-quarter earnings results. The results have been better than expected. On the Earnings per Share front, 79% of the companies that have posted earnings have been better than the estimates. That is better than the 5-year and 10-year averages. The results that have beaten have been better by 6.9% on average, less than the 5-year average and slightly above the 10-year average. 74% of the companies have reported better-than-expected revenues by an average of 2.17%. The results beat the 5-year and 10-year averages for both frequency and magnitude. The street still expects full-year 2023 earnings to grow by 1.2%. Second-quarter earnings are expected to decline year-over-year by 5%, the third quarter is expected to grow by 1.7%, and the fourth quarter is expected to increase by 8.8%. The forward Price Earnings ratio is 18.1x, the same as at the end of March. Google, Amazon, and UPS results were disappointing, while investors cheered results from Exxon Mobile, Meta, and Microsoft results.

The preliminary read of the first quarter GDP came in at 1.1%; the street was looking for 2.3% growth. The GDP price deflator was slightly hotter than expected at 4%; the consensus estimate was 3.8%. The first quarter’s Employment Cost Index rose 1.2% more than the expected 1.1%. 70% of ECI is made up of wages, which increased by 1.2%. Initial Jobless Claims came in at 230k, while Continuing Claims fell slightly to 1865k. The Federal Reserve’s preferred measure of inflation, the PCE, came in line with estimates on both the headline and core readings. PCE grew by 0.1% month-over-month and fell to 4.7% from 5.1% year-over-year. Core PCE, which excludes food and energy, came in at 0.3% month over month and fell to 4.6% from 4.7% on a year-over-year basis. The final April reading of the University of Michigan’s Consumer sentiment came in line with estimates at 63.5, while Consumer Confidence results were less than expected at 101.3. Finally, Personal income rose more than expected at 0.3% as Personal Spending came in flat.

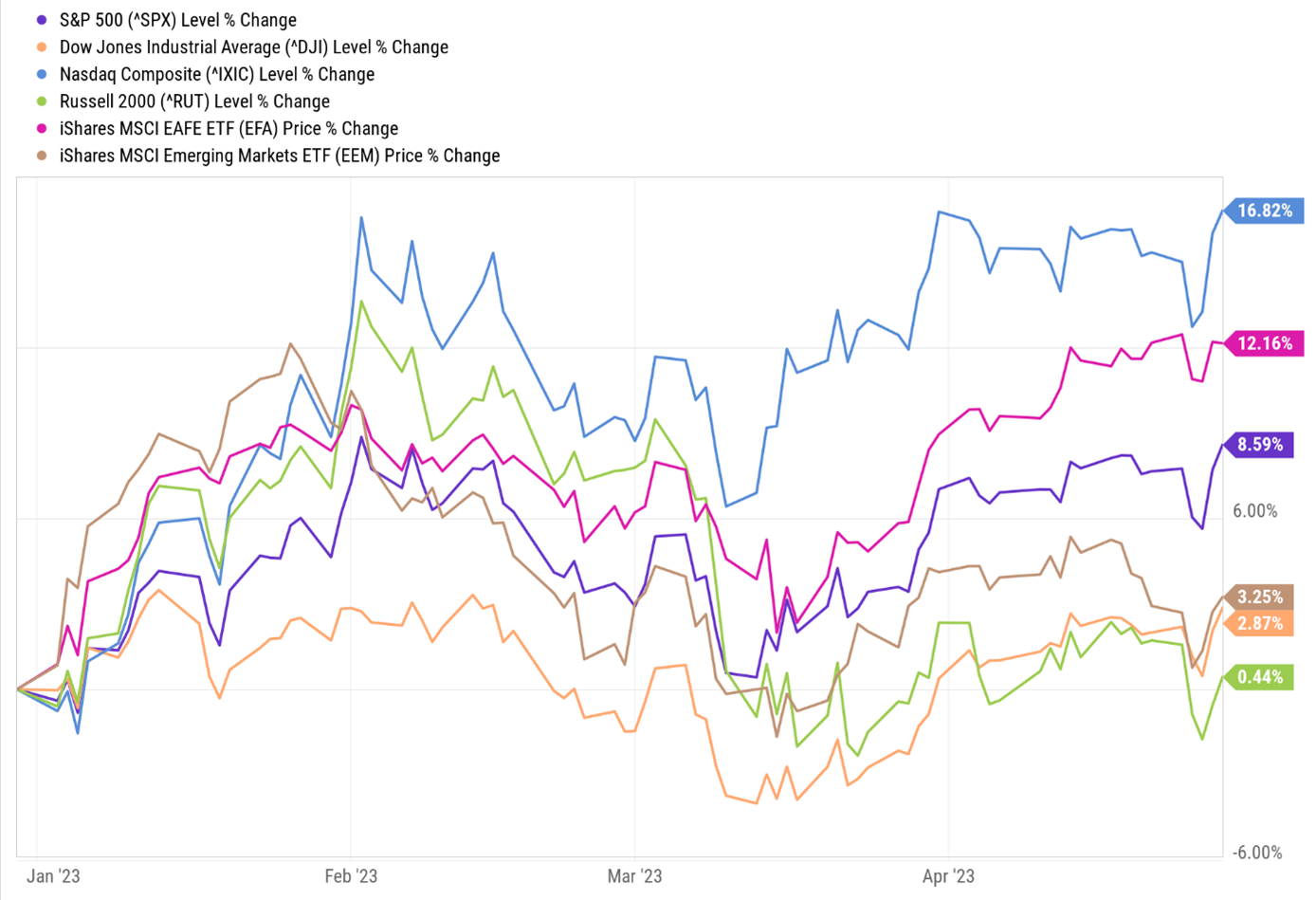

The S&P 500 gained 0.87% for the week and closed April with a 1.46% advance. The S&P 500 is up 8.59% for the year. The Dow gained 0.86% for the week, was up 2.48% for April, and is up 2.87% year to date. The NASDAQ rose 1.28% over the week, was up 0.04% for April, and holds a 16.82% advance in 2023. The Russell 2000 fell 1.11% on the week, lost 1.86% in April, and is up 0.44% for the year.

US Treasuries produced gains in the last week of April and held on to their April advance. The 2-year note yield fell by ten basis points for the week to close at 4.06%, while the 10-year bond yield fell by twelve basis points to 3.45%. The Federal Reserve will meet for its May meeting this Tuesday and Wednesday, where it is widely expected to raise the Fed Funds rate by another twenty-five basis points.

Oil prices fell 1.4% on the week but gained 1.8% for the month, with WTI closing at $76.76 a barrel. Gold prices advanced by $7.9 to close at $1998.70 an Oz. Copper prices continued to fall, losing $0.09 to $3.89 an Lb.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.