Weekly Market Commentary – 3/31/2023

-Darren Leavitt, CFA

Global equity markets ended the first quarter with impressive gains as concerns surrounding the banking system eased. A two-day congressional hearing on the failure of Silicon Valley Bank catalyzed the call for more banking regulation; at the same time, government officials called for extending and expanding the Fed’s emergency lending facility. Additionally, the FDIC announced that it had sold $72 billion in SVB’s assets to First Citizens Bancshares. The financial sector traded higher on the week but was off more than 6% in March. The rally in equity markets was also propelled by US PCE data that showed a slight moderation in prices.

The S&P 500 gained 3.48% on the week, retook and held its 50-day moving average of 4017, and closed at 4109. The S&P 500 advanced 3.51% for the month and is up 7.03% for the year. The Dow rallied 3.22% for the week, the NASDAQ increased by 3.37%, and the Russell 2000 added 2.78%. The symmetrical weekly returns suggest a good dose of quarter-end window dressing as portfolio managers rebalanced their books.

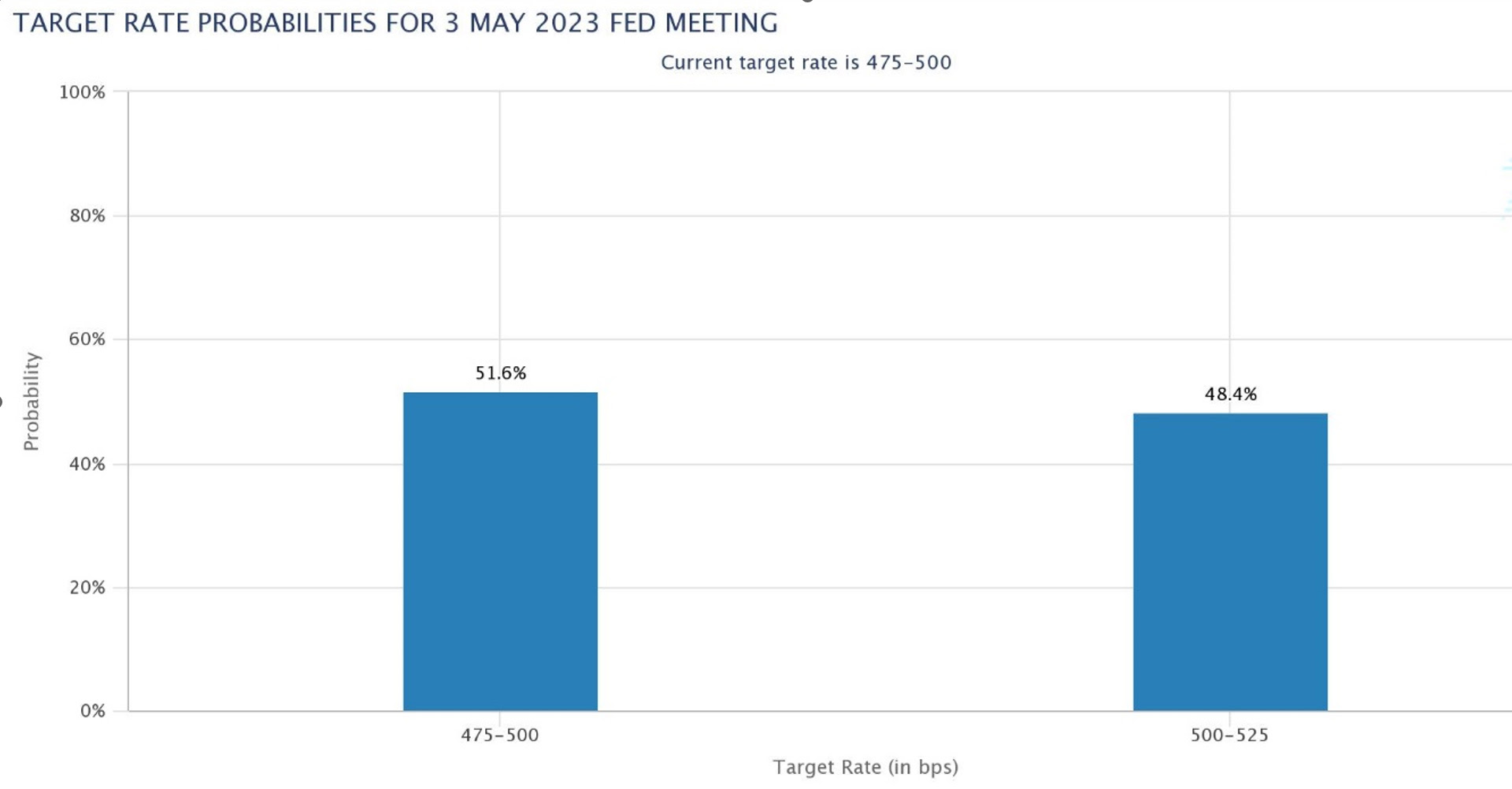

Treasuries sold off across the yield curve after a Wild Toads ride over the month. The 2-year yield increased by twenty-nine basis points to 4.06% but shed seventy-four basis points in March and thirty-six basis points in the first quarter. The 10-year yield increased by eleven basis points to 3.49% but decreased by forty-three over March. The US yield curve remains inverted, with the 2-10 spread narrowing to fifty-seven basis points. Of note, Fed Fund futures suggest a 50-50 chance that the Fed will increase their policy rate by another 25 basis points in their May meeting.

West Texas Intermediate crude ended the month with a strong rally as well. WTI prices retook the $70 price level gaining $6.15 or 8.8% to close the week at $75.38 a barrel. Gold prices closed the month at $1986.70 on muted traded. Copper prices advanced $0.02 to close at $4.08 an Lb.

Economic data for the week showed mixed results on how the consumer feels about the economy, a resilient labor market, and further moderation in inflation. March Consumer Sentiment came in below expectations of 63.4 at 62, while March Consumer Confidence was better than the expected 101.5 at 104.2. The reports showed that consumers were able to weather the banking crisis and think inflation is expected to come down, but at the same time, they are worried about their economic futures. Initial jobless claims increased by 7k to 198k, while Continuing Claims increased by 4k to 1.694 million. Personal Income came in line at 0.3%, while Personal Spending came in slightly lower than expectations at 0.2%. PCE, the preferred measure of inflation by the Fed, came in at 0.3% on a month-over-month basis and was up 5% on a year-over-year basis, down from 5.3% in the prior month. Core PCE came in at 0.3% in February and was up 4.6% year-over-year, down from 4.7%.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.