Weekly Market Commentary – 7/1/2022

-Darren Leavitt, CFA

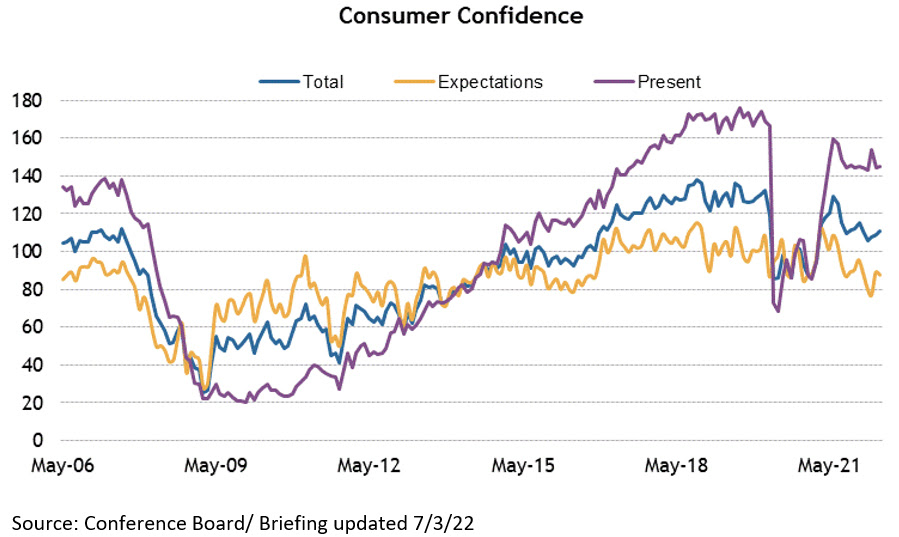

Markets took a step back after the prior week’s impressive rally. The same culprits showed up to dampen investors’ appetite for risk assets- growth concerns, inflation, and hawkish central bank rhetoric. Economic data was notably skewed to the negative and highlighted by a very weak consumer sentiment reading. The Atlanta Fed’s estimate of 2nd quarter GDP was slashed to -2.1%, and their third estimate of Q1 GDP was revised to -1.6%. If the 2nd quarter GDP is, in fact, negative, it suggests the economy is already technically in recession. Semiconductors took the brunt of this week’s selloff, falling 9.3%, as Micron and Taiwan Semiconductor reduced their outlook and fostered concerns for corporate earnings growth. The Core PCE and GDP Price Deflator continued to show inflation well above the Fed’s mandate and induced more hawkish comments from Fed officials. San Francisco Fed President Mester announced that she was comfortable with a 75 basis point hike in the July meeting. At an ECB forum, Chairman J Powell reiterated that price stability was paramount even at the cost of economic growth.

The S&P 500 fell 2.2%, the Dow lost 1.3%, the NASDAQ led declines giving back 4.1%, and the Russell 2000 shed 2%. Countercyclical sectors such as Utilities, Consumer Staples, and Healthcare outperformed. Consumer Discretionary, Financials, and Large Cap Growth issues underperformed. Growth concerns coupled with the notion that inflation may have peaked put an excellent bid into US Treasuries. The 2-year note yield fell twenty-three basis points to 2.83%. Similarly, the 10-year yield fell twenty-four basis points to 2.89%. The price of WTI increased by $1.00 to $108.67 a barrel and helped the energy sector bounce. Gold prices fell by $21.6 or 1.1% to $1808 an Oz. Copper prices continued to fall and may also be an indication of slower growth. Copper prices fell 3% to 3.62 an Lb. Crypto traded lower, with Bitcoin trading below 19k at one point. Grayscales’ bid to have an SEC-registered Spot Bitcoin ETF was rejected by the SEC and subsequently challenged by Grayscale. Finally, the US dollar was stronger against the majors.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involvement risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.