Weekly Market Commentary -5/27/2022

-Darren Leavitt, CFA

Happy Memorial Day, and thank you to all that have served our great country.

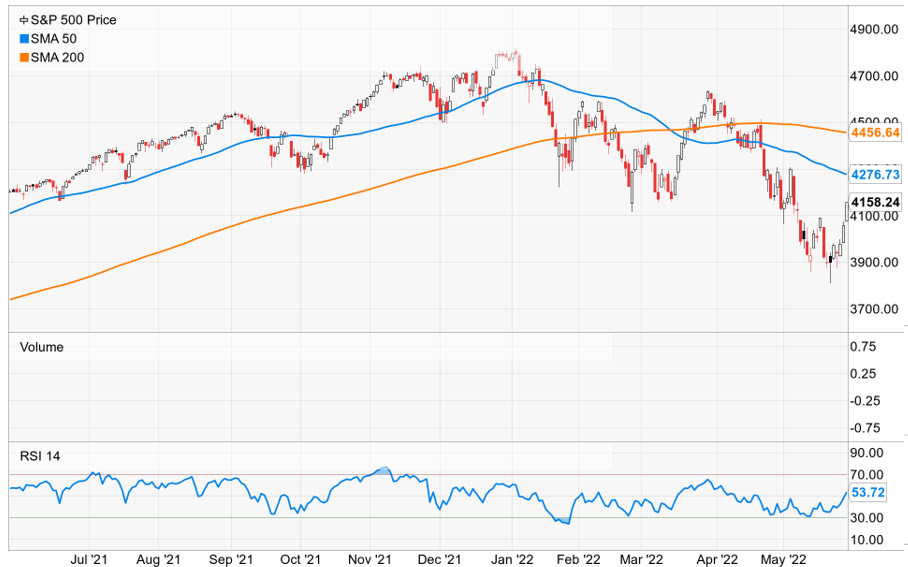

Global financial markets rallied as buy the dip investors finally showed up on Wall Street. US Markets were especially strong after losing for seven consecutive weeks. Market sentiment is quite negative, and the market was very oversold, which created a ripe environment for a bounce. Q1 earnings continued to come in mixed as management teams tempered expectations for the coming quarter and full year on continued concerns regarding the supply chain disruptions and higher inflation. However, this week we saw initial sell-offs in earnings news from some prominent names reverse to sizeable gains; NVidia and Dicks Sporting Goods are two examples, perhaps another indicator of an intermediate low. An ease in Covid lockdown measures in China also buoyed markets on the notion that the supply chain could now start to normalize. Economic data showed a slowdown in housing, a slight pullback in inflation, and deteriorating consumer sentiment.

The S&P 500 gained 6.6%, the Dow rose 6.2%, the NASDAQ outperformed with a 6.8% advance, and the Russell 2000 was higher by 6.5%. The yield curve steepened as Treasuries inked the third week of gains. The 2-10 spread widened week-over-week to 28 basis points from 21 basis points. The 2-year yield fell twelve basis points to 2.46%, while the 10-year yield declined by five basis points to 2.74%. FOMC minutes released on Wednesday showed that the Fed is inclined to increase rates at the next two meetings by 50 basis points and showed no real support for a 75 basis point move. The minutes were as expected but seemed to provide the market with some solid footing concerning the policy rate. The lower move in yields also curbed the US Dollar’s appetite, which fell against the Yen, Euro, and British Sterling for a second week. Gold prices increased by $11 and closed at $1851.40 an Oz. Oil prices rose 4.2% or $4.70 to close at $114.75. The move in oil helped propel the energy sector higher by over 8% for the week.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involvement risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.