Weekly Market Commentary – 12/23/2021

-Darren Leavitt, CFA

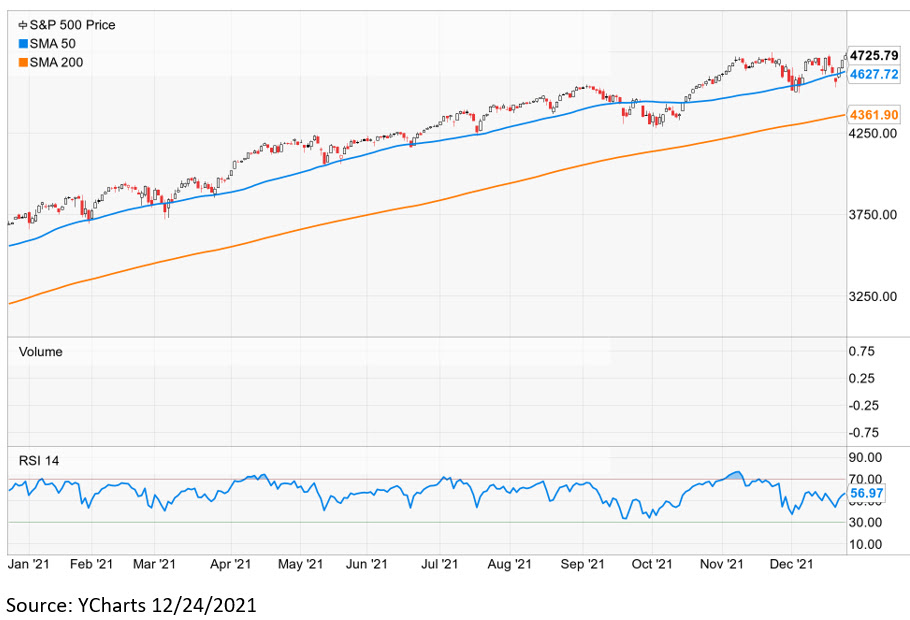

The holiday-shortened week produced another all-time high for the S&P 500 as investors looked past the ramifications of the Omicron variant and bought last week’s market dip. Technically, the S&P 500 had fallen below its 50-day moving average, which over the last year has been a level where investors have been rewarded for moving back into stocks. News related to Omicron dominated the headlines throughout the week, with massive spikes of reported infections but appeared to come with less severe illness. The CDC said that the Omicron variant is now the dominant strain of the Coronavirus and represented 73% of new infections in the US. President Biden announced that he would utilize FEMA to support multiple fronts to areas most affected by the virus. Additionally, he announced that the government would supply half a billion at-home rapid tests this winter and add more than 10,000 new vaccination sites across the country. Investor sentiment was further bolstered when the President announced no new lockdown measures. News from last weekend that Senator Joe Manchin from West Virginia would not support the Build Back Better bill hit certain parts of the market, but news that the door might still be open for further negotiations helped push stocks higher. Economic data for the week was positively skewed.

The S&P 500 gained 2.28% for the week while the Dow added 1.65%, the NASDAQ increased 3.19%, and the Russell 2000 rose 4.75%. The US Treasury curve steepened a bit as the yield on the 2-year note increased five basis points to 0.69%, and the 10-year yield rose by nine basis points to close at 1.49%. Oil prices increased 3.7%, or $2.69, to $73.62 a barrel. Gold prices increased by $6.9 to close at $1811.90 an Oz. Copper prices were also higher by 2.3%, closing at $4.394 a Lb. Risk-on sentiment bleed into the Crypto markets, with Bitcoin gaining 8.8% or $4,144.4 to $50,996.40.

Economic data announced over the week was encouraging for the most part. On the labor front, Initial Claims came in at 205k, which was in line with estimates. Continuing claims fell by 8k to 1.859 million. The third estimate of Q3 GDP came in at 2.3% better than the consensus estimate of 2.1%. The GDP Deflator, which measures prices for all goods and services that encompass GDP, showed an increase of 6%, slightly higher than the expected 5.9%. Personal Income rose 0.4% over the prior month versus an estimated 0.5%. Personal Spending came in line at 0.6%. Headline PCE came in at 0.6% and grew 5.7% year-over-year, higher than 5.1% in the prior month. Core PCE, which excludes food and energy, came in at 0.5% versus an estimate of 0.4% and rose 4.7% over the last year. New Home sales were 12% higher month-over-month to a seasonally adjusted figure of 744 units which was less than the expected 770k units. The final reading of the University of Michigan’s Consumer Sentiment for December came in at 70.6 versus 70.4 and was better than the November reading of 67.4.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involvement risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.