Weekly Market Commentary – 11/12/2021

-Darren Leavitt, CFA

US financial markets fell from record-high levels as increases in inflation continued to weigh on investor sentiment. The tape was full of corporate news highlighted by the break-ups of General Electric and Johnson & Johnson, the record IPO of EV manufacturer Rivian, and the slide in Tesla’s share price induced by CEO Elon Musk’s sale of five billion dollars of stock. Geopolitical news was also prevalent throughout the week. In China, General Secretary Xi Jinping’s Historical Resolution was passed by the communist party, ensuring him a historic third term as General Secretary. In Washington, President Biden touted the Bi-partisan passing of the Infrastructure Bill, which will be signed into law on Monday. However, support for the Reconciliation Bill paused as the CBO announced that it would not have a score on the bill until after Thanksgiving. In Eastern Europe, Russia continued to amass troops along the Ukrainian border while US warships sailed into the Black Sea. Economic data for the week painted a more permanent picture of inflation which has continued to affect sentiment indicators.

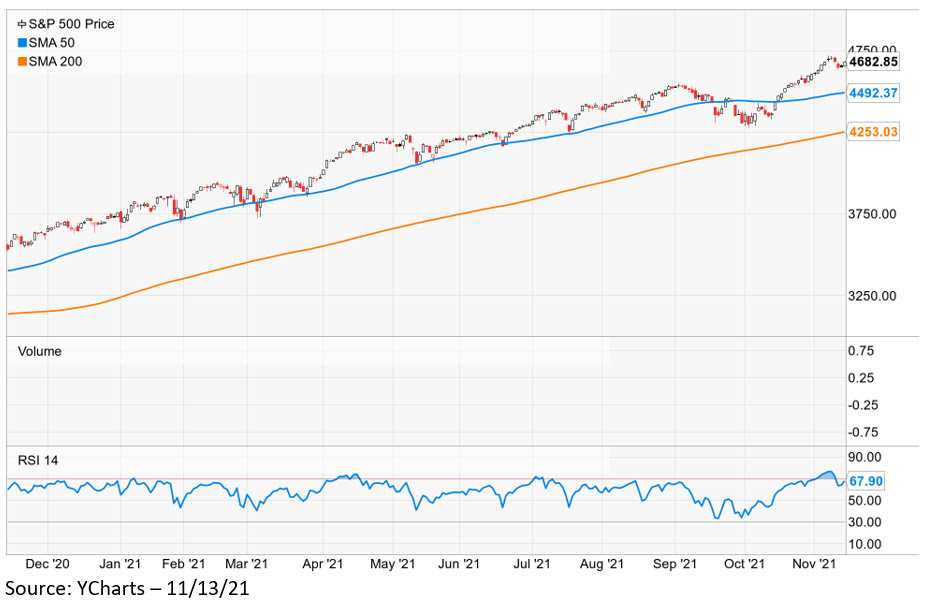

The S&P 500 lost 0.3% for the week, the Dow fell by 0.6%, the NASDAQ gave back 0.7%, and the Russell 2000 shed 1%. US Treasuries gave up all of their gains and more from the prior week. Bond prices fall as yields rise. The 2-year note yield gained twelve basis points, closing at 0.52%. The 10-year yield increased by thirteen basis points to close at 1.58%. Interestingly, the 3-year and 5-year notes had even more profound moves and came as the Federal Reserve started to taper its asset purchase program. Notably, the results of the US Treasury’s debt auctions for the week were awful. A hot CPI print changed rate hike expectations, increasing the Fed’s probability of an initial move in June of 2022 from 50% to over 70%. Additionally, the market has now priced in three rate hikes between now and the first half of 2023. Gold prices increased by 2.8% or $51.8, closing at $1868.70 an Oz. Oil prices fell on the week, losing $0.42 to $80.83 a barrel. Data showed a second consecutive build in crude inventories as OPEC + announced it expects oil demand to fall in 2022. Copper prices increased 3% or $0.13 to $4.45 an Lb. Bitcoin lost $4k on the week to close at $63,505.

Economic data for the week was a bit disappointing. Investors were focused on inflation data. The PPI or Producers Price Index was slightly better than expected, with the headline number coming in at 0.6% versus expectations of 0.7%. Core PPI, which excludes food and energy, was better, coming in at 0.4% versus 0.5%. At the consumer level, CPI or Consumer Price Index missed the mark in a big way. The range in expectations was very wide, but the results were higher than the largest estimate. Headline CPI came in at 0.9% on a month-over-month basis relative to the consensus estimate of 0.6%. On a year-over-year basis, consumer prices increased 6.2%, the highest level since 1990. Core CPI was also hotter than expected, coming in at 0.6% versus the consensus estimate of 0.4% and on a year-over-year basis grew 4.6%. Rent increases were notable in the report and are a component that will likely continue to increase over the next couple of quarters. Small Business Optimism fell short of expectation, as did the preliminary reading of the University of Michigan’s Consumer Sentiment, both of which pointed to inflation as the primary reason for the declines. On the employment front, JOLTS job openings were slightly lower than the prior reading but still encouraging at 10.438 million. Initial Jobless claims came in at 267k while Continuing Claims ticked up a bit to 2.16 million.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involvement risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.