Weekly Market Commentary – 9/17/2021

-Darren Leavitt, CFA

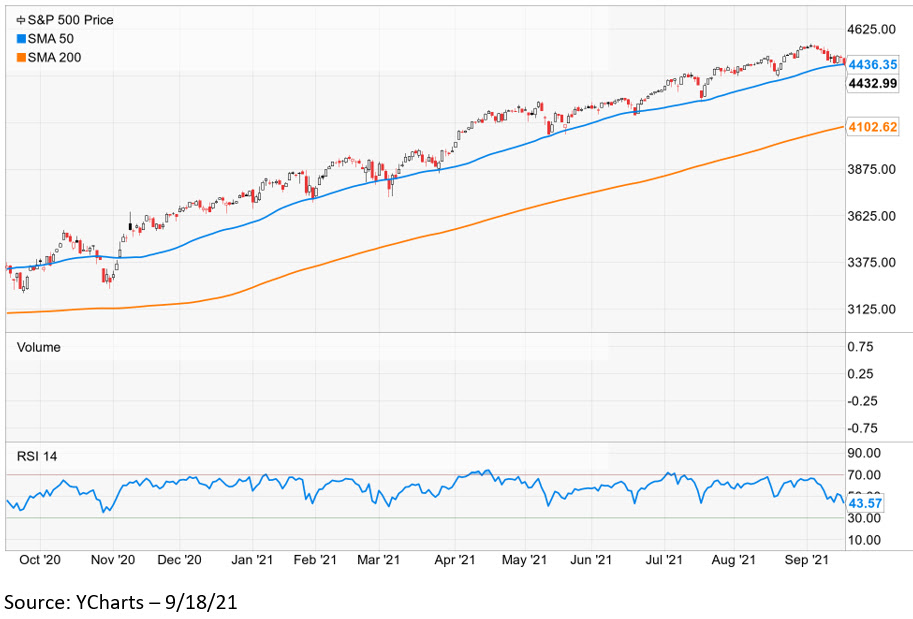

US financial markets endured another week of losses that ended with the S&P 500 closing below its 50-day moving average on a quadruple witch expiration. Although investors were treated to better than expected economic data, the peak growth narrative still made the rounds. No real progress was made on the infrastructure bill as politicians addressed the Federal government’s debt ceiling. Corporate news was negatively skewed, and no real positive catalyst came out of Apple’s new product introduction. In China, regulators continued their recent crackdowns this week, focusing on the gaming sector. Additionally, China’s largest property development company defaulted on debt payments. The default is concerning, and markets will be keeping an eye on how Beijing responds, especially if the default becomes more of a systematic problem.

For the week, the S&P 500 lost 0.6%, the Dow gave back 0.1%, the NASDAQ fell 0.5%, and the small-cap-focused Russell 2000 was able to buck the trend with a gain of 0.4%. Trading in US Treasuries was again all over the place. The 2-year note yield increased two basis points to close at 0.23%, while the 10-year yield increased three basis points to 1.37%. Oil prices gained 3% or $2.17 to close at 71.92 a barrel. The metals complex had a tough week. Gold prices fell 2.2% or $40.8 to $1751.20 an Oz. Copper prices sank 5% to 4.241 an Lb.

Economic data for the week was better than expected. The headline CPI print came in at 0.3% less than the expected 0.4%. Retail sales surprised to the upside in a big way. The headline number came in at 0.7%, while the consensus estimate was – 0.7%. Ex Autos’ was also better than expected, coming in at 1.8% versus -0.2%. Initial claims and Continuing Claims continued to trend in the right direction. Initial claims came in at 332k, and Continuing Claims came in at 2.665 million, down from the prior reading of 2.852M. The Philly Fed reading was also much more robust than expected, coming in at 30.7 versus the consensus estimate of 19.6. Finally, the preliminary September reading of the University of Michigan’s Consumer sentiment came in at 71, which was slightly better than expected.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involvement risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.