The Internal Revenue Service announced on Wednesday, November 6, that several contribution limits in qualified retirement plans will increase next year.

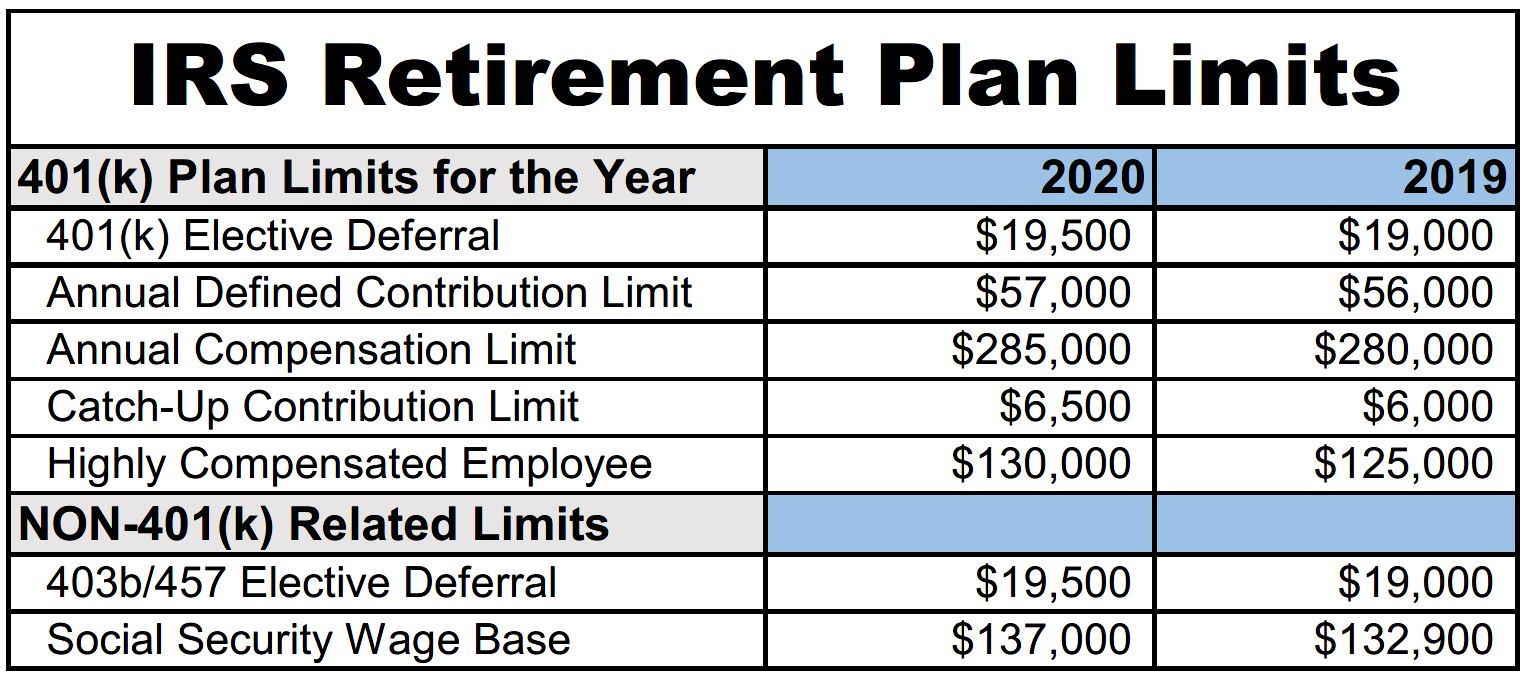

The IRS announced the increases as part of an annual adjustment for cost-of-living increases as provided in the Internal Revenue Code. According to IRS Notice 2019-59, employees participating in 401(k) plans may contribute up to $19,500 in 2020, up from $19,000 for this year. This increase also applies to 403(b) plans, most 457 plans, and the federal government’s Thrift Savings Plan. In addition, the catch-up contribution limit available to employees aged 50 or older will increase from $6,000 to $6,500 in 2020.

The limit on the annual benefit for a participant under a defined benefit plan will increase from $225,000 to $230,000 in 2020. In addition, the limit on the annual benefit for a participant under a defined contribution plan has increased from $56,000 to $57,000 for 2020.

The IRS also announced increases in phase-out income ranges for determining a taxpayer’s eligibility to deduct contributions made to Individual Retirement Accounts (“IRAs”). If a taxpayer meets certain conditions, such as annual income limits, the taxpayer can deduct contributions made to traditional IRAs. However, these deductions are phased out depending on the annual income of a taxpayer, or a taxpayer’s spouse, who is covered by a retirement plan at work. For example, the phase-out income range for a single taxpayer covered by a workplace retirement plan ranges from $65,000 to $75,000 for 2020, which is an increase from $64,000 to $74,000 for 2019. The phase-out range has also increased for married couples filing jointly when the spouse making contributions to the IRA is covered by a workplace retirement plan. The income range is $104,000 to $124,000 for 2020, which is an increase from $103,000 to $123,000 for 2019. For a full list of phase-out income ranges for taxpayers who take this deduction, Notice 2019-59 can be accessed at the bottom of this page.

In addition, the income limit for married couples filing jointly who take the Retirement Savings Contributions Credit is $65,000 for 2020, which is an increase from $64,000 for 2019. For heads of household, the income limit is $48,750 for 2020. Also, for single taxpayers or married individuals who file separately, the income limit for this tax credit is $32,500 for 2020.

One limit that will not change in 2020 is the limit on annual contributions to an IRA, which remains at $6,000. Moreover, the IRA catch-up contribution limit remains at $1,000 for individuals aged 50 or older.

https://www.wardandsmith.com/articles/retirement-plan-contribution-limits-will-increase-in-2020