Monthly Market Commentary – March ’22

-Darren Leavitt, CFA

In March, global financial markets continued to be volatile, focused on the Russian/Ukraine war and inflation rates not seen in decades. Countries worldwide condemned Russia’s invasion of Ukraine and started to place significant sanctions on Russia. Similarly, hundreds of global corporations announced that they would stop doing business with and within Russia. President Biden traveled to Europe to meet with EU officials, NATO allies, and the leader of Poland to show a united front. The ramifications of the war and sanctions sent commodity prices through the roof. Oil touched $130 a barrel while wheat traded limit up for five days in a row. Trade-in nickel saw the industrial metal above $100,000 a metric ton, and the London Metal Exchange halted trading for several days. The incremental increases in commodity prices come as consumers were already facing higher costs due to Covid related supply chain distortions.

Economic data on inflation continued to run hot and has probably not fully priced in the commodity inflation. Global Central Bank policy continued to diverge as certain geographies face different circumstances. A profound move in the Dollar/Yen cross induced the Japanese Government to buy up Japanese Government Bonds to keep the currency in check. A strong move in the dollar was also seen relative to the Euro. Mid-month, the equity market stabilized on what appeared to be constructive negotiations between Russia and Ukraine. Commodity markets took a bit of a breather on the tone and moved lower off overbought conditions. Equities in the US rallied over 11% in a two-week time frame as quarter-end approached, and institutional investors sought to rebalance their holdings. On the other hand, the US Treasury flattened and eventually inverted across several parts of the curve, which some think portends a recession in the next 6 to 24 months.

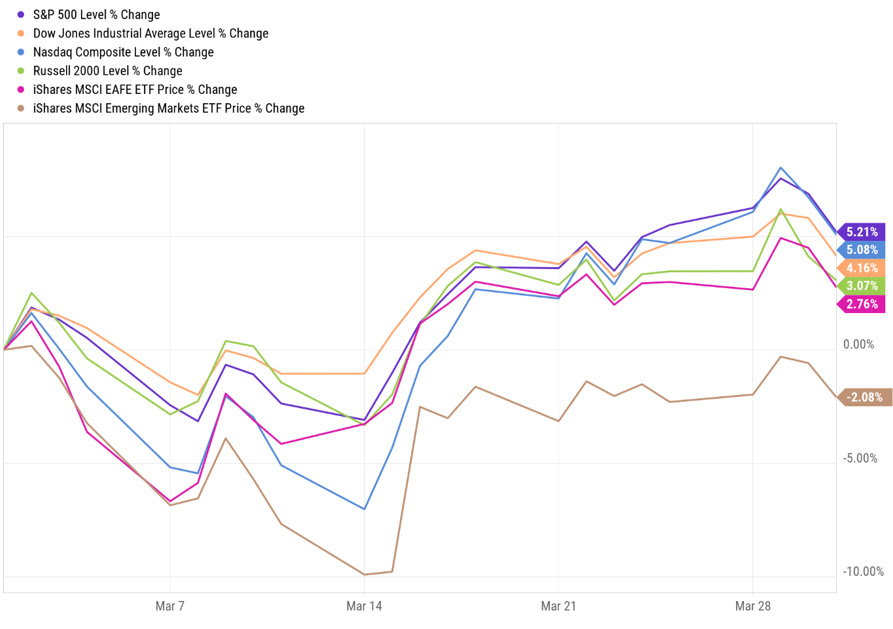

The S&P 500 gained 5.2%, the Dow added 4.16%, the NASDAQ rose 5.08%, and the Russell 2000 increased 3.07%. International Developed markets added 2.76% while emerging markets lagged, losing 2.08%. The 2-year yield increased by eighty-five basis points to 2.28%. The 10-year yield rose forty-seven basis points to 2.33%. Oil prices increased by 5.1% or $4.90 to close at $100.43 a barrel. Gold prices jumped $52 or 2.7%, to close at $1953 an Oz. Copper prices gained 6.5%, closing at $4.75 a Lb.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involvement risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.