Monthly Market Recap for January 2022

-Darren Leavitt, CFA

It was not a pleasant start to 2022 for investors as global financial markets took a few steps back. Increasing inflation concerns and the prospect for higher interest rates dampened sentiment. The Omicron variant also did not help matters as infections increased and hindered the economic recovery. Geopolitical tensions were also on investors’ minds as Russia continued to position troops on the border of Ukraine.

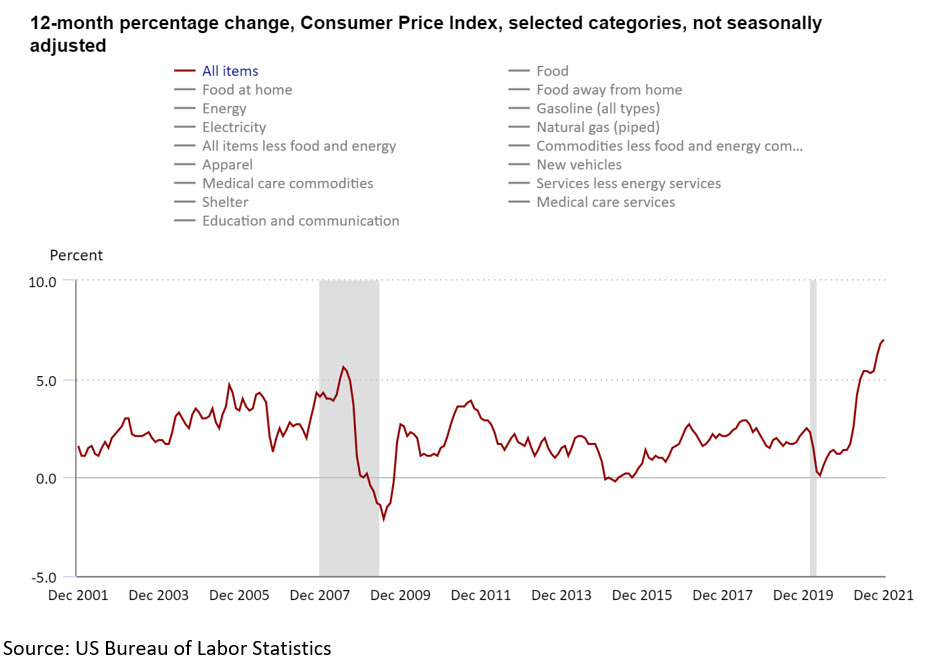

Consumer prices in December increased 7% on a year-over-year basis, the hottest reading since 1982. Similarly, Producer Prices increased by 9.7%. The preferred measure of inflation by the Federal Reserve, the PCE, was up 5.8% over the last year. Wages and increased housing costs appear to be the most permanent components of inflation. Still, commodity input prices and freight costs continued to manifest strains within the global supply chain. To combat inflation, the Federal Reserve is now likely to raise rates in March after it has wound down its asset purchasing program. Additionally, the market has priced in four rate hikes in 2022, much more than anticipated just a couple of months ago.

The notion of higher rates resets investment fundamentals. The hardest hit in the reset has been growth stocks which were down 9.3% relative to value stocks that lost just 1.2%. Higher valuations in growth stocks come under pressure as interest rates rise. The bond market also comes under pressure as rates rise. The yield on the 2-year note increased forty-three basis points in January, closing at 1.16%. The 10-year bond yield increased by twenty-seven basis points to 1.78% while the 30-year bond increased nineteen basis points to 2.10%. Interestingly, longer-dated Treasuries did not sell off as much.

The Omicron variant, while more infectious, has proven to be less severe, especially in those that have been vaccinated. However, the virus still induced lockdowns across multiple geographies and stalled the economic recovery. The surge of infections from December and January hurt consumer sentiment, which fell to 67.2 in January from the prior reading of 68.8. The variant also dampened retail sales, which fell 1.9% in December. While these variables likely played a role in the January sell-off, it appears Omicron infections are receding. That coupled with a well-positioned consumer may lead to a hasty jumpstart to the economic recovery in the coming months.

US, NATO, Russian, and Ukraine tensions monopolized headlines throughout January and influenced markets. An escalation and an eventual invasion of Ukraine would have widespread consequences. Oil and Natural Gas prices soared in January partly on the likelihood of supply disruptions if there is a conflict. Stiff economic sanctions on Russia have been on the table in negotiations and, if acted on, will cause more interruptions to the supply chain outside of the energy complex.

The S&P 500 lost 5.3%, the Dow shed 3.3%, the NASDAQ fell 9.5%, and the Russell 2000 gave back 9.7%. International Developed markets were down 5 .3%, and emerging markets lost 1.9%. The Treasury curve flattened with the 2-10 spread decreasing to sixty-two basis points. The global bond aggregate index fared better than equities losing 2%. A combined measure of US Treasures fell 1.9%, while emerging market debt fell 2.9%. Gold prices fell 1.7% or $31.6 to $1796.5 an Oz. Oil prices increased by a whopping 17.3% or $13.01 to close at $88.16 a barrel.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involvement risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.